Investment Objective :

This portfolio offers a special way to invest in the Indian market by focusing on specific themes. As India moves towards becoming a $7 trillion economy, the total value of Indian companies is expected to grow by 11-12% each year. The portfolio aims to take advantage of India’s growth by investing in companies that operate in socially responsible ways.

It avoids investing in companies that might conflict with investors’ moral, social, religious, or environmental values. This means the portfolio chooses investments carefully to respect these beliefs while still aiming to deliver good returns.

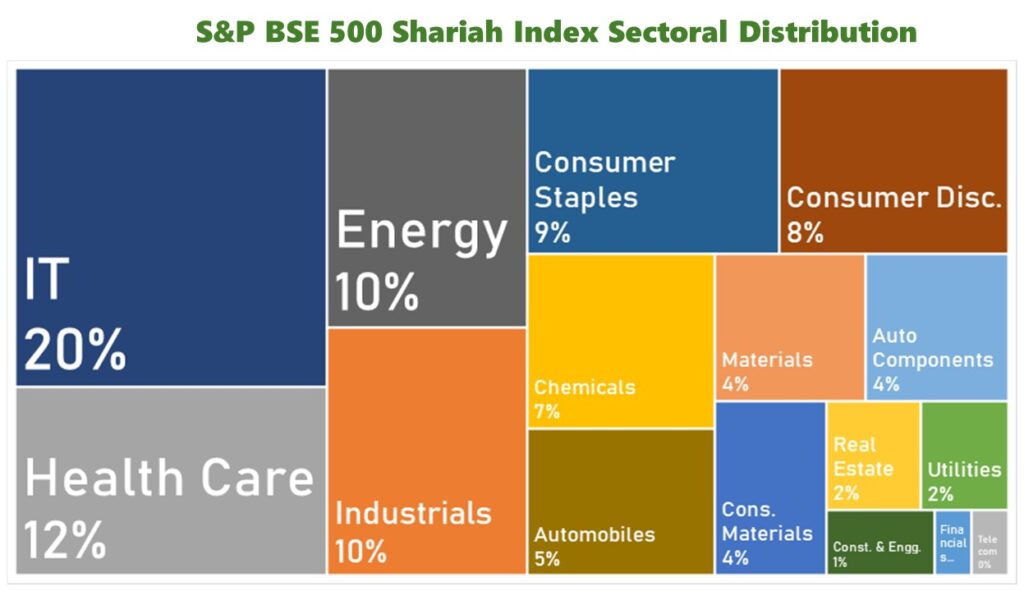

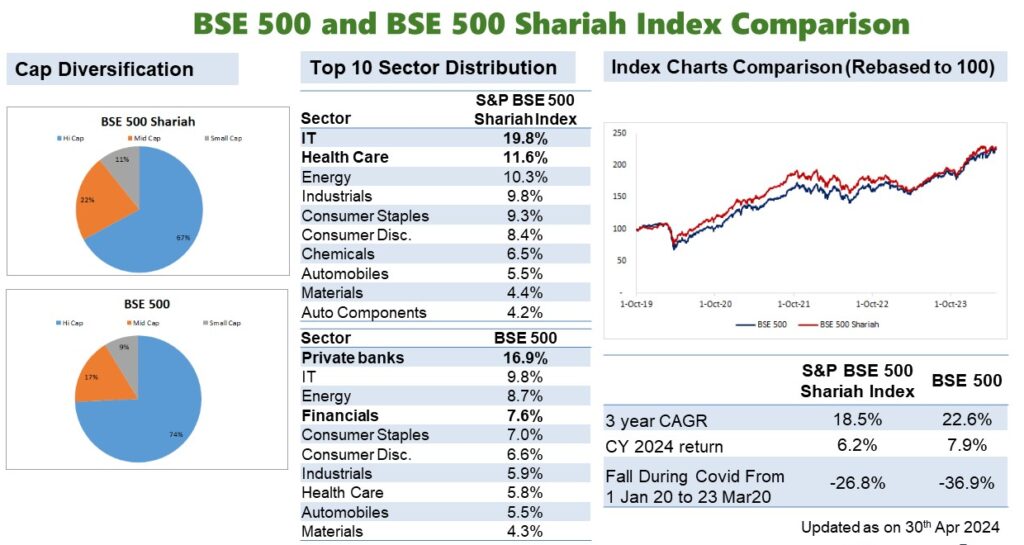

The performance of this portfolio is compared to the S&P BSE 500 Shariah Index, which is a standard for ethical investing in India.

Fundamental Characteristics

Universe Selection : Based on S&P BSE 500 Shariah Constituents as it is one of the Ethical Universe in Indian Equity Market.

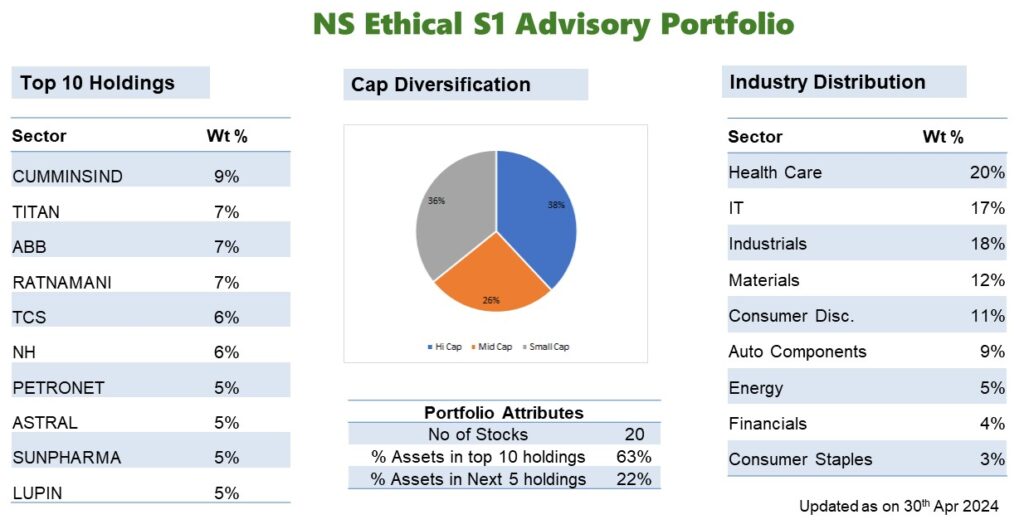

Portfolio Contour : Stocks would be from all the three caps namely- large, mid and small cap segments of the market.

Stock Selection : Based on our Investment Framework of ‘Growth in Value’ and ‘Principle of Linearity’ and rigorous research on 5Ms parameter

Stock Strategy : The portfolio will consist of 15-25 stocks with Maximum Weight on any one stock will be 15%

Return Expectations : Margin of safety for higher than GDP growth over the next 5 years

Risk Management : Stock Limits, Sector Limits, Tracking Price and Fundamental Performance

S&P Dow Jones Indices works with a company called Ratings Intelligence Partners (RI) to ensure that stocks meet Shariah (Islamic law) standards. RI is a consulting firm based in London and Kuwait, specializing in Islamic investments. Their team includes Islamic scholars who review business practices to ensure they comply with Shariah principles. The scholars involved are:

For the S&P BSE 500 Shariah index, all the companies in the S&P BSE 500 are reviewed for Shariah compliance. Only common stocks (ordinary shares) are considered, and any stock that does not meet Shariah standards is excluded. The remaining compliant stocks make up the index.

The Investment universe for the NS Ethical Advisory Portfolio is S&P BSE 500 Shariah Index which is updated by BSE each month. Out of 500 companies in BSE 500, S&P BSE 500 Shariah Index comprises of 313 stocks. These constitute the universe for creation of the portfolio. NS Ethical Advisory Portfolio is also benchmarked to S&P BSE 500 Shariah Index. If a portfolio constituent has been removed by the Index, exit in the portfolio is done within 60 days.

Weightage | S&P BSE 500 Shariah Index | BSE 500 |

Top 10 companies | 38.0% | 35.9% |

Top 50 companies | 67.6% | 63.1% |

Top 100 companies | 82.3% | 76.3% |

NS Ethical Advisory portfolio is a multi cap – sector diversified portfolio based on S&P BSE 500 Shariah Index

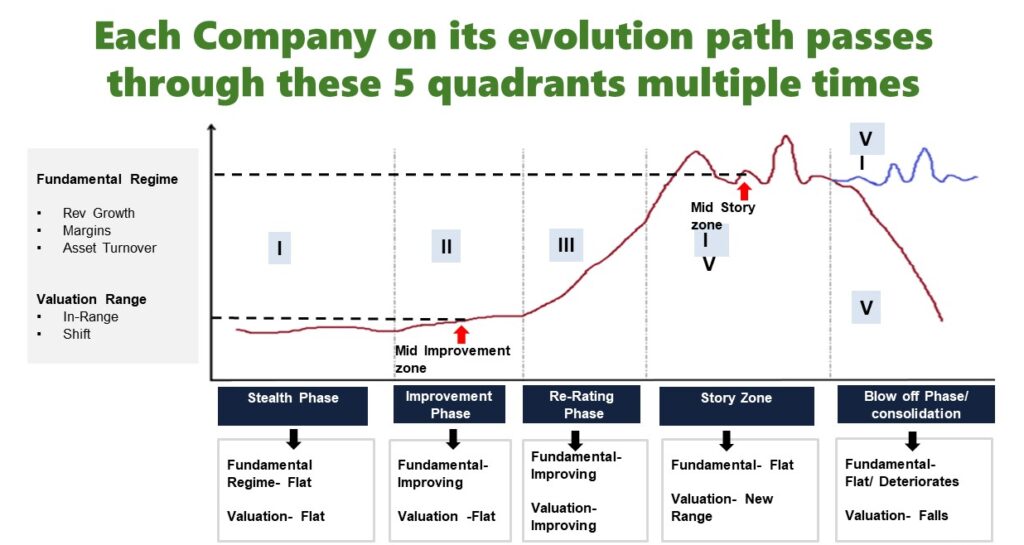

Companies in the portfolio are rigorously tracked for risk and reward on fundamental research basis and based on Investment thesis and Rebalancing methodology, appropriate restructuring in the portfolio is done. The portfolio selection is based on Narnolia’s Investment philosophy of Growth in Value and Principle of linearity and 360 degree research methodology

The portfolio invests in companies of high quality where growth is visible in near and long term with margin of safety for price appreciation. The risks associated with companies in the portfolio are tracked through active Risk management framework. The Risk and Reward of Shariah Index is parallel with BSE 500.

QUALITY: Good Quality is our starting reference for Stock selection. It has 3 aspects

GROWTH: When a good quality company grows in business terms, it brings maximum gain opportunity for Investors. Growth here means growth in Operating matrices of business which should lead to growth in PL and BS finally bringing growth in return ratios of companies. A Momentum In Return Ratios- RoE, RoCE or the Free Cash flows of company is considered growth here.

VALUATION

The risk-reward in terms of Price appreciation probability with the right valuation parameter and the right range.

How do I start investing ethically with IAP?

You can begin by opening an account with us by Clicking Here.

What’s the minimum amount I need to invest?

You’ll need at least Rs. 2,50,000/- to get started.

What are the charges?

2% per annum on the Assets Under Management (AUM), which is split into 1% upfront for the first 6 months based on the daily average AUM. Brokerage charges apply only when there is rebalancing in the portfolio, along with statutory costs.

How many stocks are included?

Between 15 to 25 stocks are included in the portfolio.

What’s the benchmark for performance?

The benchmark we compare against is the S&P BSE 500 Shariah Index.

What’s the level of risk?

The investment strategy is considered aggressive in terms of risk.

What’s the time frame for investment?

There’s no lock-in period, meaning you can withdraw your investment at any time. However, we recommend keeping it invested for at least 5 years to build substantial wealth.

A unique theme-based portfolio which refrains from investing in those companies which may be against moral, social,

religious or environmental beliefs of investors.

Key Features :

• The portfolio is a long only portfolio. It is based on S&P BSE 500 Shariah Index Constituents which is one of

the Ethical Universe in Indian Equity market

• Stock Selection Method is Based on Investment Framework of ‘Growth in Value’ and ‘Principle of Linearity’

and rigorously research on 5Ms process visualizing – Market, Management, Moat, Financial Model and

Multiples

• The portfolio will consist of 15-25 stocks with Maximum Weight on any one stock will be 15%

• Rebalancing as per changes in the S&P BSE 500 Shariah Index.

• Portfolio companies rigorously tracked for risk and reward on fundamental research basis.

• Based on Investment thesis and Rebalancing methodology, appropriate restructuring in the portfolio is done.

The portfolio is best suited for investors who wish to invest into companies that conduct business in

socio- responsible ways